While markets continue to... melt under the weight of Donald Trump’s new threats toward China, an interesting article describes the new, “silent” crisis in the repo market — a hidden liquidity crisis linked to the recent problems in regional banks.

The repo market (repurchase agreements) is the short-term lending market between banks and investment institutions, with collateral in government bonds or other securities.

Simply put:

a bank that immediately needs liquidity (cash) temporarily sells a security to another bank, with the commitment to repurchase it in 1–14 days (or even overnight).

That is the “repo” (repurchase agreement).

The opposite side of the transaction is called reverse repo (when the bank is the one lending liquidity and temporarily buying the security).

Most people have never heard of this “small monster”... that is growing rapidly.

Here is the article.

Essentially, banks are once again beginning to distrust one another, as the tide of liquidity recedes and reveals some zombie banks that... are swimming without a life jacket.

Even the slightly healthier banks are moving away from the sea, because no one wants to be caught in raging waves.

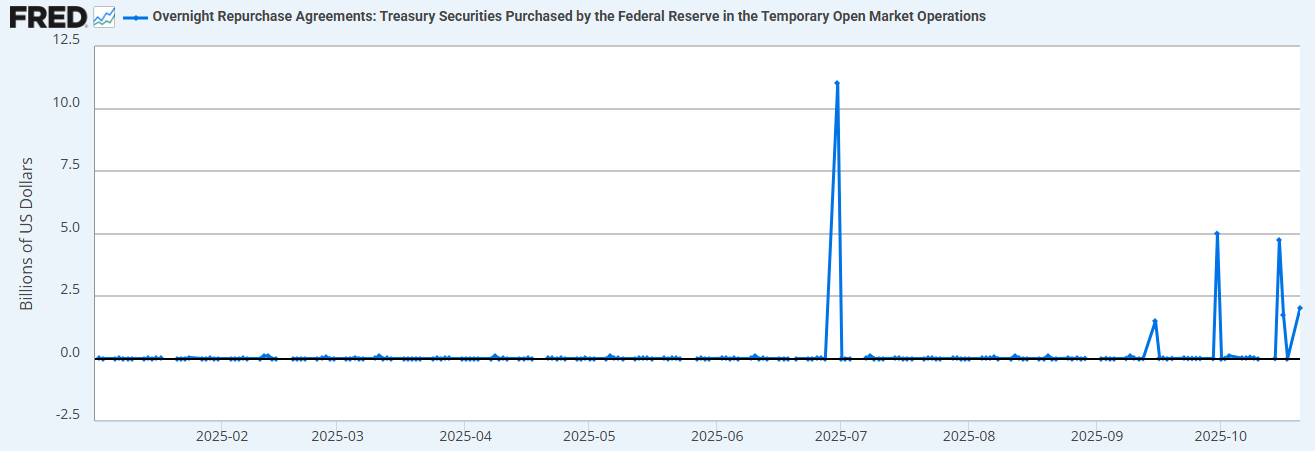

Thus, the Federal Reserve is forced to support them quietly, through repo operations, as interbank liquidity dries up. (And wait until you see the size of the “offer” they put on the table — without... advertising it!)

The liquidity crisis in the so-called shadow banking sector is exactly what Jamie Dimon fears (the... “cockroaches” he mentioned in his recent... warning), because when liquidity dries up, the shadow banks run to the big ones for repos.

And his own bank was the detonator of the major repo crisis of 2019 — the one called “Repocalypse.”

Back then, the banking system “froze” because JPMorgan stopped expanding its risk exposure in shadow banking.

In other words, it cut off repo loans, the... lubricant that keeps the cash flow of the banking system running smoothly.

The Fed had to rush in with massive Quantitative Easing (QE) to save it.

But today’s Fed, sensitive to inflation, avoids repeating that — because that flood of liquidity, which half a year later turned into “helicopter money” for households, was the seed of the massive inflation we’ve been struggling to control ever since — and paying for daily.

The Bubble of Everything

The explosion of the zombie bank bubble was always part of the scenario for the great Bubble of Everything, the “generalized bubble” that had been gradually forming. It was estimated to arrive five years ago — back then, the peak was projected in 2–3 years.

But the Fed injected so much... “helicopter” money that the cycle lasted longer.

Now, however, liquidity is drying up, the economy is declining, and problems are beginning to show — like the bones of a zombie through its thin skin.

The new repo crisis

Regional banks are once again in dire straits.

This time, the crisis began with defaults on business loans and is evolving into yet another multi-billion-dollar bailout through the repo market.

On October 16, 2025, the Federal Reserve Bank of New York quietly injected $8.35 billion into the system through a repo operation — and that’s only the publicly recognized amount.

About 80% of these transactions were backed by Mortgage-Backed Securities (MBS) rather than by safe government bonds.

When banks start “pledging collateral” with MBS (securities backed by mortgages) instead of bonds, it means they are desperately thirsty for cash. It’s like someone selling first the television, then the car, and finally the wedding ring.

And the Fed knows it...

That’s why it silently announced a new Standing Repo Facility worth $491.65 billion the same day — nearly half a trillion in overnight emergency liquidity. You don’t prepare half a trillion unless something bad is happening behind the scenes.

Here’s the crux: it may turn out that this crisis is just as big as the Repocalypse of 2019.

In the best-case scenario, it’s the beginning of a... movie titled “Zombie Apocalypse” in the financial sector — the revelation of which Zombie Companies survive only through cheap borrowing and will collapse when cheap liquidity ends.

As I had predicted, a considerable zombie army will emerge during the recession.

And the most alarming thing is that the first zombies are already emerging from the banking sector.

We’ve crossed the point of no return.

You cannot print money indefinitely within a debt-based system.

You cannot pretend everything is fine when the repo front has caught fire again.

Get ready — the “party” is just beginning.

www.bankingnews.gr

Σχόλια αναγνωστών